In this Ask the Expert, Tyler Thomas answers questions about the Hurricane Insurance Protection – Wind Index (HIP-WI) endorsement that offers coverage against losses from qualifying hurricanes and tropical storms. Tyler is a risk management specialist for the Risk Management Agency (RMA). He’s worked for RMA for three years and focuses on researching and developing changes to improve the crop insurance program. Before joining RMA, Tyler worked in the field at an Approved Insurance Provider (AIP) for five years. He joined RMA to use his specialized experience and understanding of crop insurance policies to make a difference for the American farmer.

What is the Hurricane Insurance Protection – Wind Index (HIP-WI) Program?

The HIP-WI program is an endorsement that is added to your federal crop insurance policy. This program covers the “deductible” portion of risk against hurricanes and tropical storms, if elected.

HIP-WI was first offered in 2020 to give producers in hurricane prone areas an opportunity for added protection.

Are tropical storm losses covered under HIP-WI?

Yes. RMA added the Tropical Storm option starting with the 2023 crop year after getting producer feedback. Tropical storms are only covered by HIP-WI if you select the Tropical Storm option. This will cost an additional premium but provides coverage for damage caused by strong weather systems that aren’t categorized as hurricanes.

What crops are covered under HIP-WI?

HIP-WI covers a wide range of crops in hurricane prone areas. Chances are if you can purchase an underlying policy for the crop, HIP-WI coverage will be available.

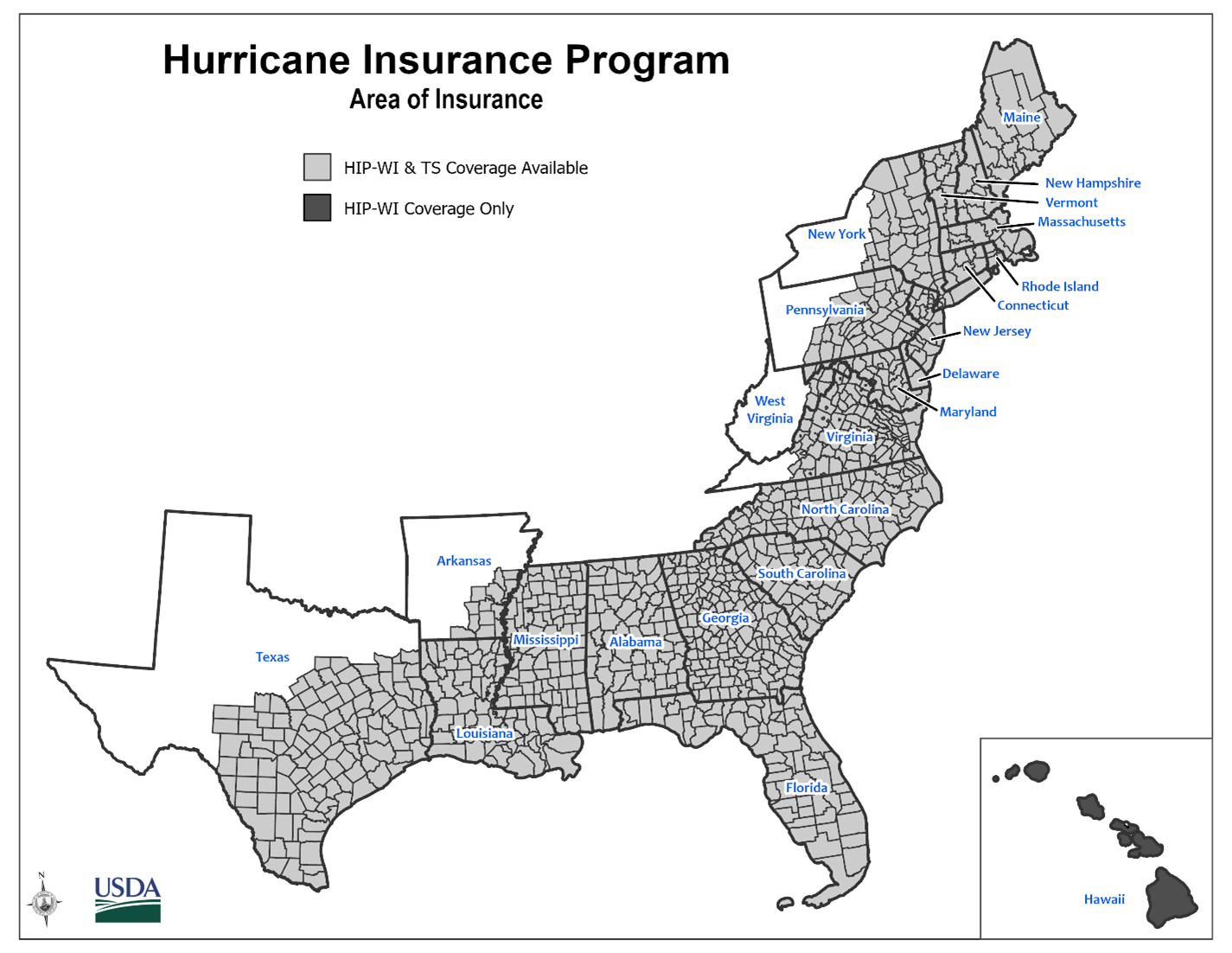

What states and counties are eligible?

HIP-WI is available in select counties in the following states:

What triggers a HIP-WI payment?

For a HIP-WI payment, the trigger is 64 Knots Per Hour (KPH) wind speeds entering your county or an adjacent county. If you elected the Tropical Storm option, the trigger is 34 KPH wind speeds entering your county AND a county wide weighted average of six inches of rain in a four-day period (the day before the Tropical Storm winds enter your county, the day of, and two days after the arrival of the winds). Just like with HIP-WI, your county can also receive an indemnity if a county adjacent to yours triggers.

What is the coverage period?

For most crops, the coverage period starts when the crop is planted through the end of the hurricane season in early December. Like every insurance product, there are always exceptions, so be sure to talk with your crop insurance agent to find out the specifics.

Is there a fee?

Yes. The HIP-WI endorsement does cost an additional premium and if the Tropical Storm option is selected it will cost an additional premium as well. A crop insurance agent can help you obtain a premium quote, or you can use the cost estimator tool.

When is the sales closing date?

Upcoming sales closing dates are Jan. 31, Feb. 28, Mar. 15, April 15, May 1, and May 15. The sales closing date is generally the same as the sales closing date for your underlying policy. That way you can add HIP-WI and make any changes to your underlying policy at the same time. Contact your crop insurance agent to learn more about sales closing dates in your area.

How do I purchase coverage?

Coverage is purchased through a crop insurance agent who can walk you through coverage options and important dates that are specific to your state and county. If you need assistance locating an agent, you can use the agent locator tool.

How have producers benefitted from HIP-WI coverage?

HIP-WI provides quick indemnity payments in the event of a hurricane to help farmers get back on their feet and begin the recovery process. Producers do not need to file a claim to receive an indemnity payment, and payments are typically paid a few weeks following the eligible hurricane or tropical storm. HIP-WI payments are in addition to any applicable indemnity payments from your underlying crop insurance policy.

Over $776 million in HIP-WI payments have been issued in 2024.

Can HIP-WI coverage be combined with the Supplemental Coverage Option and the Stacked Income Protection Plan?

Yes. HIP-WI can be combined with the Supplemental Coverage Option and the Stacked Income Protection Plan when acreage is also insured by a companion policy.

Where can I find more information?

To find out more information, you can visit the HIP-WI Page or talk to a crop insurance agent. Also consider joining one of the upcoming webinars hosted by RMA where you can learn more about these products from the experts. The first webinar is Jan. 16, 2025, at 10:30 a.m. CST and the second webinar is Feb. 13, 2025, at 2 p.m. CST.

Tyler Thomas is a risk management specialist with RMA. He can be reached at Tyler.Thomas@usda.gov.